Image

News

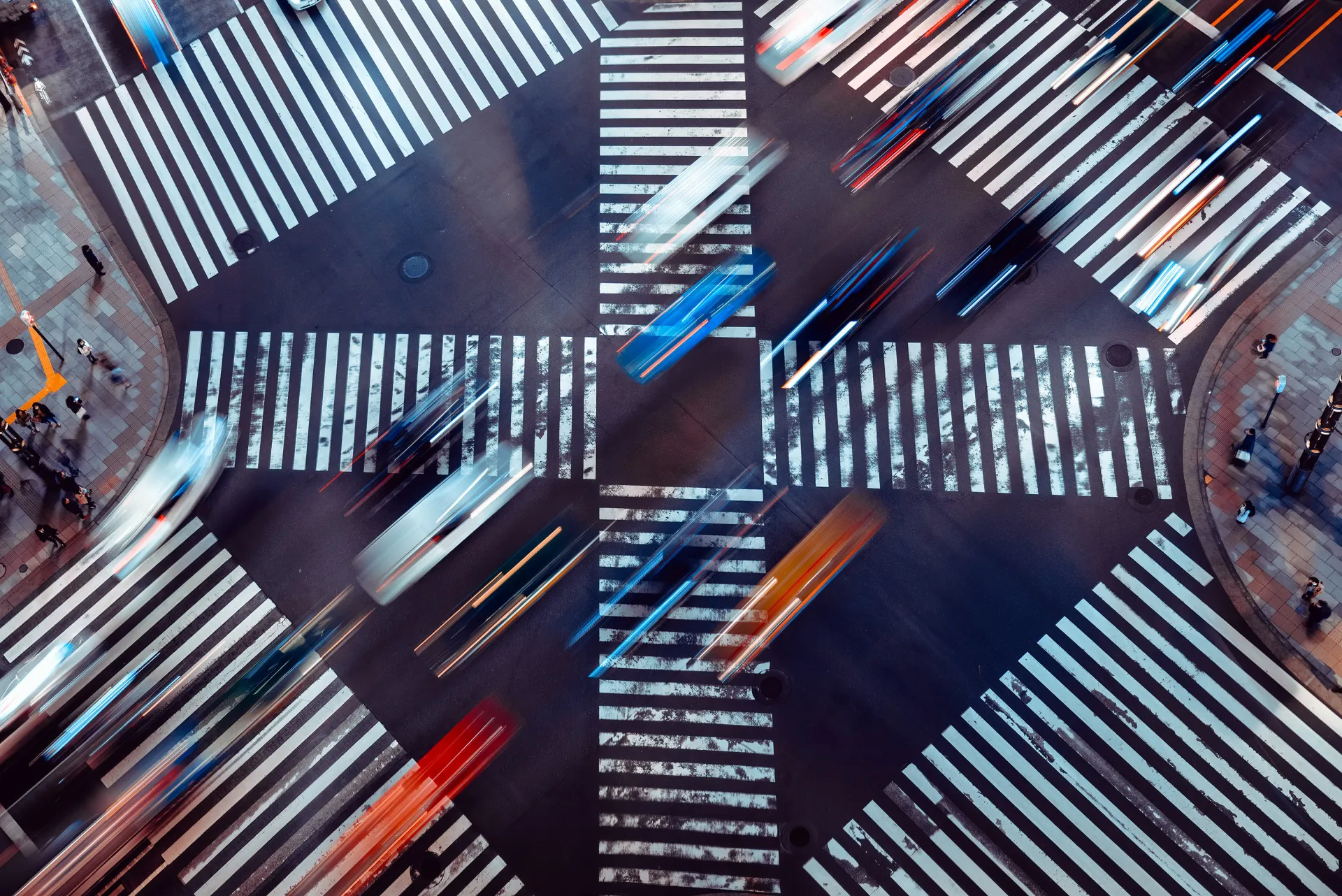

In October, the Japanese market experienced a degree of volatility but ultimately the Nikkei 225 and TOPIX indices ended the month up, at +3.1% and +1.9% respectively. Gains in the market were led by large-cap stocks, following the trend in the U.S. as major stocks hit new historic highs.

Image

Press Release

SuMi TRUST AM’s Sakigake ‘Pioneer’ Fund becomes available to UK investors

Date: 1st November 2024

Sumitomo Mitsui Trust Asset Management (SuMi TAM), one of Japan’s largest asset managers, has today announced that its Sakigake High Alpha – Japan Thematic Growth fund, a UCITS vehicle domiciled in Luxembourg, has become available to UK institutional investors.

Image

Insights

Coffee Break Column - Achieving Sustainable Inbound Tourism in Okinawa

Katsunori Ogawa, Chief Portfolio Manager of Sakigake HA

Date: 18th October 2024

As the number of foreign tourists coming to Japan swells and shows no signs of stopping typical destinations like Kyoto are feeling the strain. In an effort to support this ever growing industry, less well-trodden areas, like Okinawa, are improving their tourism infrastructure and attractions.

Image

News

New Japanese Prime Minister and the Stock Market

Date: 8th October 2024

After a three-year tenure from Fumio Kishida, on October 1st Japan elected its 102nd prime minister, Shigeru Ishiba. With a newly formed cabinet much remains uncertain, but in this article we will consider the potential impact of this change of administration on the Japanese equity market.

Image

News

Business Confidence Flat Among Japan's Big Manufacturers

Date: 4th October 2024

[External Link] Katsutoshi Inadome, Chief Strategist at SuMi TRUST, recently shared his perspective on the Bank of Japan's Tankan survey and what this means for the manufacturing sector in Japan.

Image

News

Japan’s biggest pension fund faces more pressure to deliver

Date: 4th October 2024

[External Link] SuMi TRUST AM's Chief Strategist, Katsutoshi Inadome's comments on the state of Japan's Government Pension Investment Fund have been published Financial Times.

Image

News

SuMi TRUST AM Upbeat About Japan's Semiconductor Industry

Date: 4th October 2024

[External Link] Katsunori Ogawa, Chief Portfolio Manager of the Sakigake High Alpha fund at SuMi TRUST AM, goes in depth on his conviction in the strength of the Japanese semiconductor industry.

Image

News

Bank of Japan Keeps Rates Unchanged

Date: 4th October 2024

[EXTERNAL LINK] SuMi TRUST AM's Chief Strategist, Katsutoshi Inadome shares his analysis on the outcome of the Bank of Japan's monetary policy meeting in September.

Image

News

Breaking the ice: Lessons from TNFD early adopters

Date: 4th October 2024

SuMi TRUST AM's Senior Stewardship Officer, Seiji Kawazoe comments on engagement activities within the Taskforce on Nature-related Financial Disclosures.