Coffee Break Column

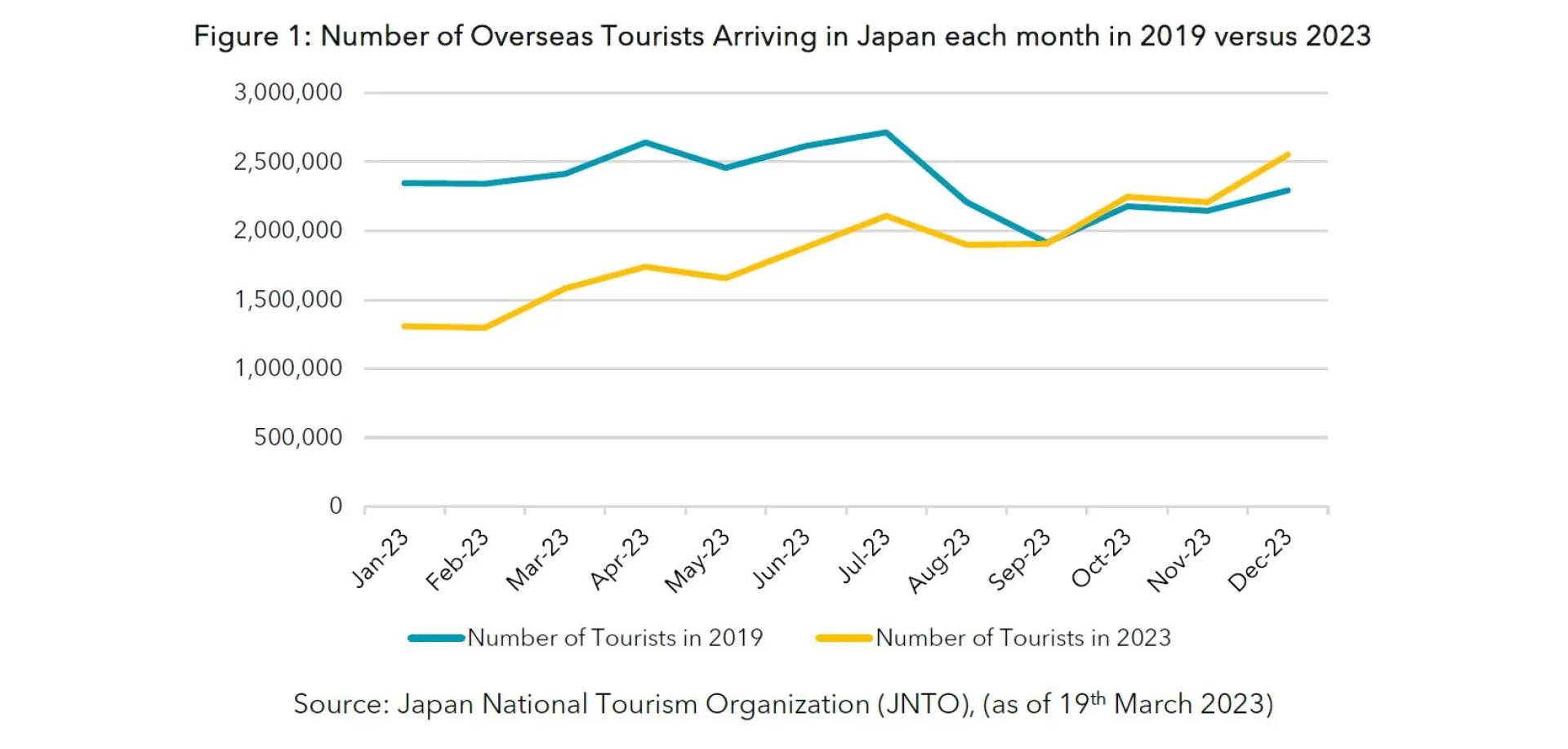

As we enter 2024 it is clear to see that inbound tourism shows no sign of stopping. The number of overseas tourists visiting Japan each month grew consistently in 2023 and has surpassed pre-COVID levels since October 2023 (Figure 1). As demand remains robust, we can anticipate the number of tourists to continue to rise into 2024. With 31.9 million foreign visitors to Japan recorded in 2023 [1], the Japanese government still has a long way to go to reach its goal of 60 million yearly foreign visitors by 2030. Nevertheless, the government seems to be on the right track.

Robust demand backed by the weak Japanese yen

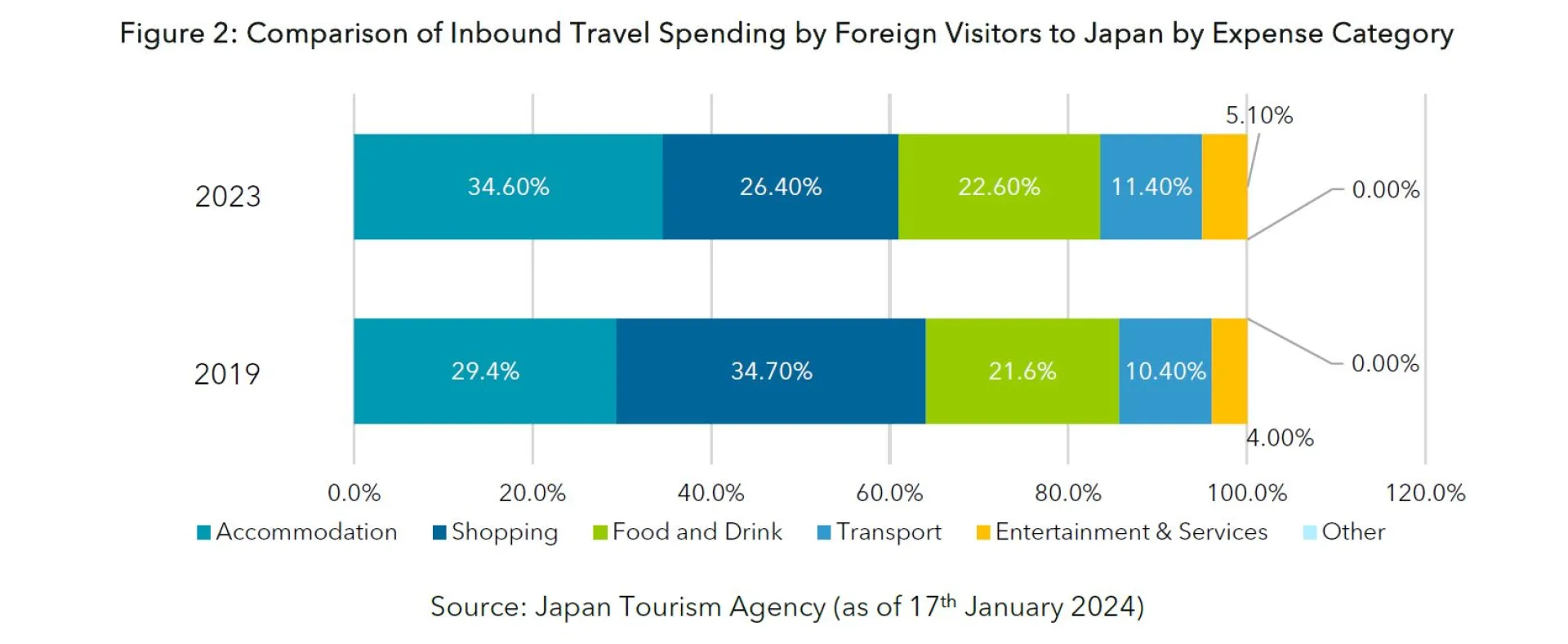

One key factor behind the resilient inbound demand is the weak yen. It is a great time for foreign tourists to visit Japan as they can enjoy better value for money. This has undoubtedly pushed up foreign spending in Japan with foreign visitors having spent a record-breaking JPY 5.3 trillion collectively in 2023, up 9.9% from 2019 according to the Japan Tourism Agency. [2]

How are tourists spending their money in Japan?

Spending on accommodation has spiked as demand outstrips supply. Out of the total amount spent by foreign visitors to Japan in 2023, accommodation accounted for the highest percentage spent at 34.6%, followed by shopping expenses (26.4%), and food and drink (22.6%). Accommodation costs now represent a larger proportion of costs, jumping from 29.4% in 2019 to 34.6% in 2023.

The rise in accommodation costs has been driven by increasing demand from foreign tourists and labour shortages in Japan. Some hotels are unable to sell out all their rooms, despite the demand, simply due to the lack of staff. As a result, hotel occupancy rates have yet to reach their pre-COVID levels, despite robust demand. On the other hand, room prices have surpassed pre-COVID levels for this very reason. According to a report by Sumitomo Mitsui Trust Bank (SuMi TRUST Bank) Research Department, the combination of the tight supply of accommodation and the high demand from tourists could present an opportunity for businesses to further raise prices. [3] This would allow said businesses to raise wages to attract and retain staff, enabling them to increase their room occupancy rates.

Demand is overtaking supply

Whilst demand for accommodation is likely to continue rising as the number of foreign tourists increases, much of that demand tends to be concentrated in larger cities such as Tokyo, Osaka and Kyoto. An unfortunate consequence of that can be overtourism, which can lead to increased congestion, safety hazards and more instances of friction with local residents. It has become such an issue in some areas that Kyoto officials have now implemented a ban on foreign tourists entering the geisha district due to increased reports of harassment of the entertainers. [4] Yamanashi prefecture is also aiming to reduce overcrowding by introducing a JPY 2,000 fee to climb Mount Fuji as safety concerns mount.

Sustainable tourism is the future

In order to facilitate a sustainable future for tourism in Japan, the government has introduced an overtourism prevention plan. The plan outlines measures to promote less-visited tourist destinations as well as to improve infrastructure. Such measures include setting up direct bus routes to popular tourist destinations from major train stations, supporting local municipalities to promote rural tourism, supporting cashless ticket purchases available in multiple languages, and raising travel fares during peak hours to encourage travel during non-peak hours. The intended goal of the plan is to promote sustainable tourism in Japan which both welcomes visitors and preserves the quality of life for residents.

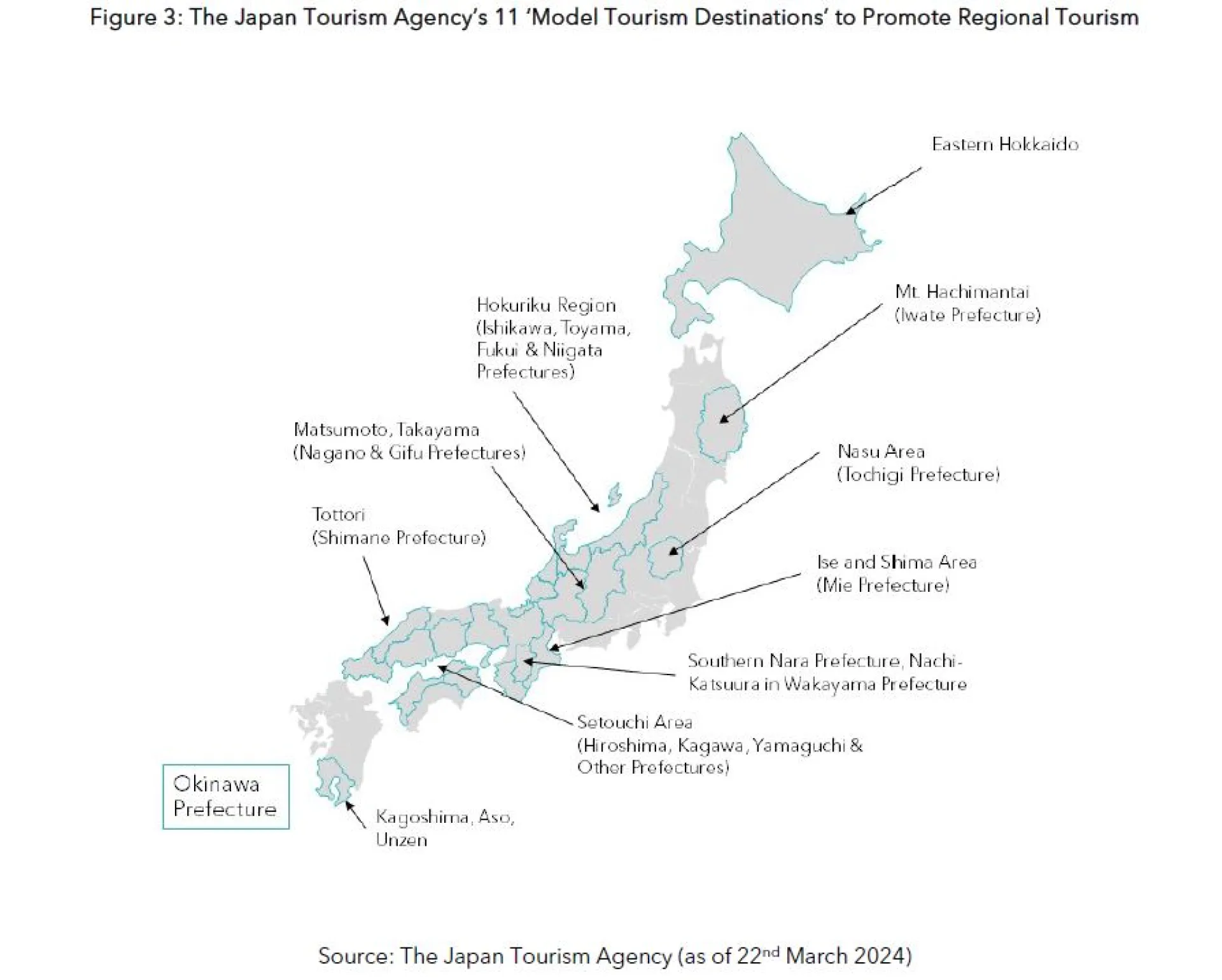

Additionally, the Japan Tourism Agency has designated 11 ‘model tourism destinations’ to encourage tourists to visit more regional destinations as opposed to metropolitan areas like Tokyo and Osaka or heavily crowded areas like Kyoto (Figure 3).

Stocks which stand to benefit from sustainable tourism

With the above in mind, I believe the following stocks are ones to watch as Japan moves its focuses toward sustainability in the tourism market.

Central Japan Railway Company (9022)

The company operates the Tokaido Shinkansen Line, between Tokyo and Osaka, which accounts for about 70% of its revenues. In addition to strong tourism and leisure demand, as the number of domestic travellers recovers, inbound demand from foreign visitors to Japan is also recovering rapidly. On the back of rising occupancy rates on Shinkansen trains, the company announced an upward revision to its FY2024/3 results. We expect the increase in passenger numbers to continue in the next fiscal year due to inbound demand from the growing number of foreign visitors to Japan. The company also expects to increase earnings growth and shareholder returns by promoting cost reductions through operational efficiency improvements. Central Japan Railway Company also operates the Takayama Main Line, one of the Japan Tourism Agency’s 11 model tourism destinations (Figure 3). [5] As such we anticipate the company to also benefit from increased tourism to this region.

Seibu Holdings (9024)

The company's two main businesses are railways and hotels, and it is expected to increase revenues from the hotel business in the future. Unit prices per hotel room are above pre-COVID levels and there has been a marked recovery in profitability due to higher room occupancy rates. The company's hotels have a high percentage of Western tourists compared to other hotels in Japan, and it is evaluated that there is more scope for future price increases compared to other hotels in the country. Further earnings growth is expected as unit room prices and occupancy rates rise simultaneously thanks to strong inbound demand. Notably Seibu Holdings owns hotels in not only in popular destinations like Tokyo and Hakone, but also more regional areas like Hiroshima, Shizuoka, Nagano, Eastern Hokkaido, and Okinawa. As such we anticipate the company to see increased occupancy rates in some of its more regional hotels as the Japanese government ups its promotion of these areas.

Kotobuki Spirits (2222)

The firm manufactures and sells branded confectionery for souvenirs, personalised gifts, and private use, matching the characteristics of each region. The company's strength lies in its sales platform and manufacturing sites covering the whole of the country from Hokkaido to Okinawa. We anticipate the company’s inbound-related sales to hover around JPY 6-7 billion this fiscal year, exceeding its historical high JPY 5.4 billion in FY2019. Increased regional tourism will provide a boon for its shops like: Setouchi Kotobuki (based in Okayama prefecture), KAnoZA Izumo (based in Shimane prefecture), Otozure-Hompo (based in Yamaguchi prefecture) and LeTAO (based in Hokkaido).

To encourage a sustainable future for Japan’s tourism industry, we must address issues like overcrowding and promote tourism to regional areas to not only reduce the concentration of tourists in certain areas, but also to provide opportunities for local businesses in rural areas with a new customer base. We believe that a focus on regional tourism will pave the way in 2024 as inbound demand continues to soar.

References

[1]JNTO, 19 March 2024, ‘訪日外客数(2024年2月推計値)’, https://www.jnto.go.jp/statistics/data/20240319_monthly.pdf [accessed on 20/03/2024]

[2]Japan Tourism Agency, 17 January 2024, ‘【訪日外国人消費動向調査】2023年暦年 全国調査結果(速報)の概要’, https://www.mlit.go.jp/kankocho/content/001718105.pdf [accessed on 12/03/2024]

[3] SMTB Research Department, October 2023, ‘インバウンド需要回復と不動産市場 ~復活するホテルセクター~’, https://www.smtb.jp/-/media/tb/personal/useful/report-economy/pdf/138_2.pdf [accessed on 12/03/2024]

[4]Justin McCurry, 8 March 2024, ‘Kyoto bans tourists from parts of geisha district amid reports of bad behaviour’, https://www.theguardian.com/world/2024/mar/08/kyoto-geisha-district-tourist-ban-gion [accessed on 12/03/2024]

[5]The Yomiuri Shimbun, 10 April 2023, ‘Japan Selects 11 ‘Model Tourism Destinations’ to Promote Regional Areas’, https://japannews.yomiuri.co.jp/features/travel-spots/20230410-102595/ [accessed on 12/03/2024]