Key Points

-

Attractive Valuations of Small Caps

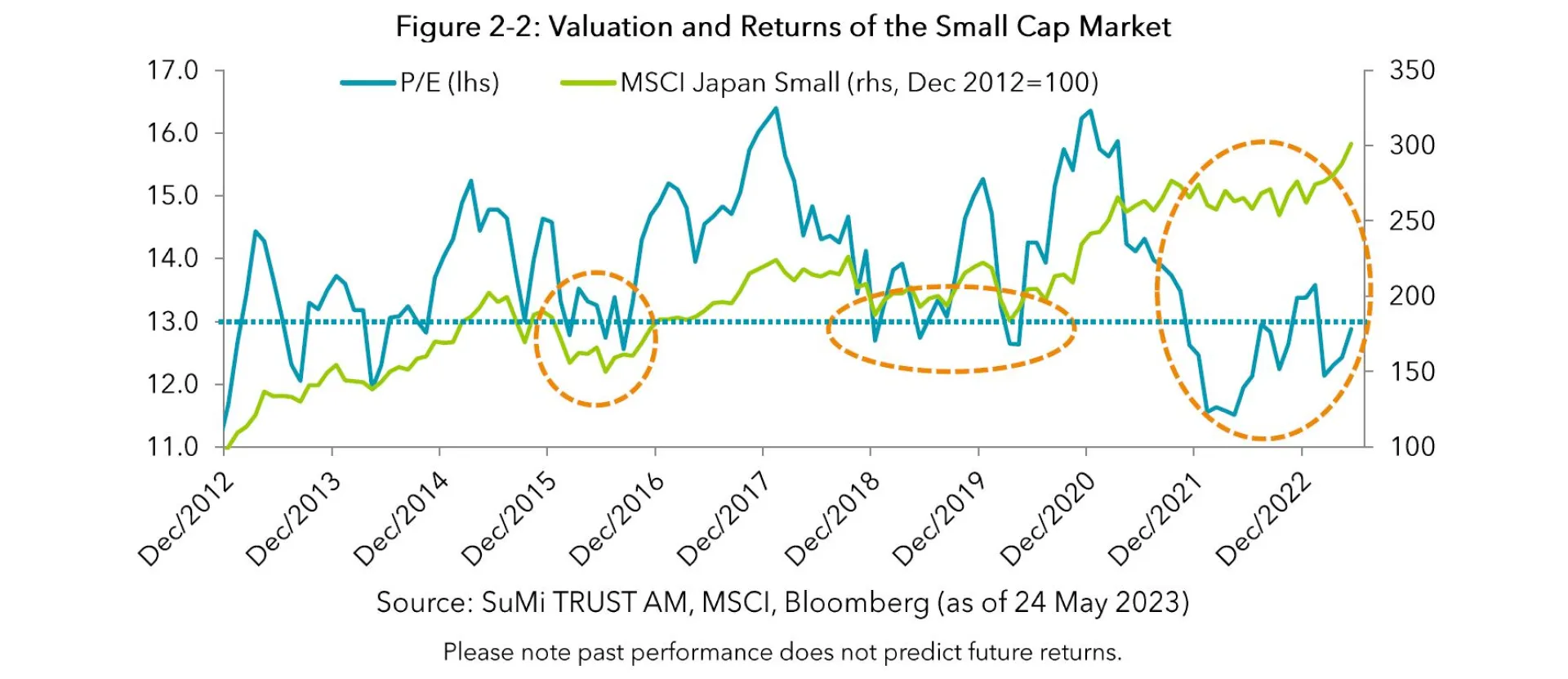

Having traded between 16.4 and 11.5 times P/E (Price-to-Earnings) over the last ten years, Japanese small cap stocks are now trading at slightly below 13 times P/E. During the last decade, the small cap market has mostly been valued above 13 times P/E. The threshold of 13 times indicated the bottom of the market since Abenomics, a set of market-friendly pro-growth policies by former Prime Minister Shinzo Abe, was introduced in 2013.

-

Discount to Large Caps

The valuation of small caps is lower than those of their large cap peers. The valuation gap between small caps and large caps is still hovering around the lowest in 10 years.

-

Small Caps are Set to Outperform Large Caps

Since 2002, the Japanese small cap market posted 1.74% annual excess returns against the large cap market. The relative valuation analysis suggests that Japanese small cap stocks are trading at a discount to large cap stocks. History suggests that it is likely that small caps will post higher returns than large caps in the following years when the smaller company multiple is lower than their larger peers.

I have regularly written columns on Japanese small cap stocks and their relative performance against large cap stocks. In this report, I would like to provide some analysis of their valuation and comparison of that against large cap stocks.

1. Large Caps vs. Small Caps: Performance Comparison

The existence of the size premium, which means that smaller cap companies outperform their larger cap peers in the medium to long run, is broadly accepted in the investment industry.

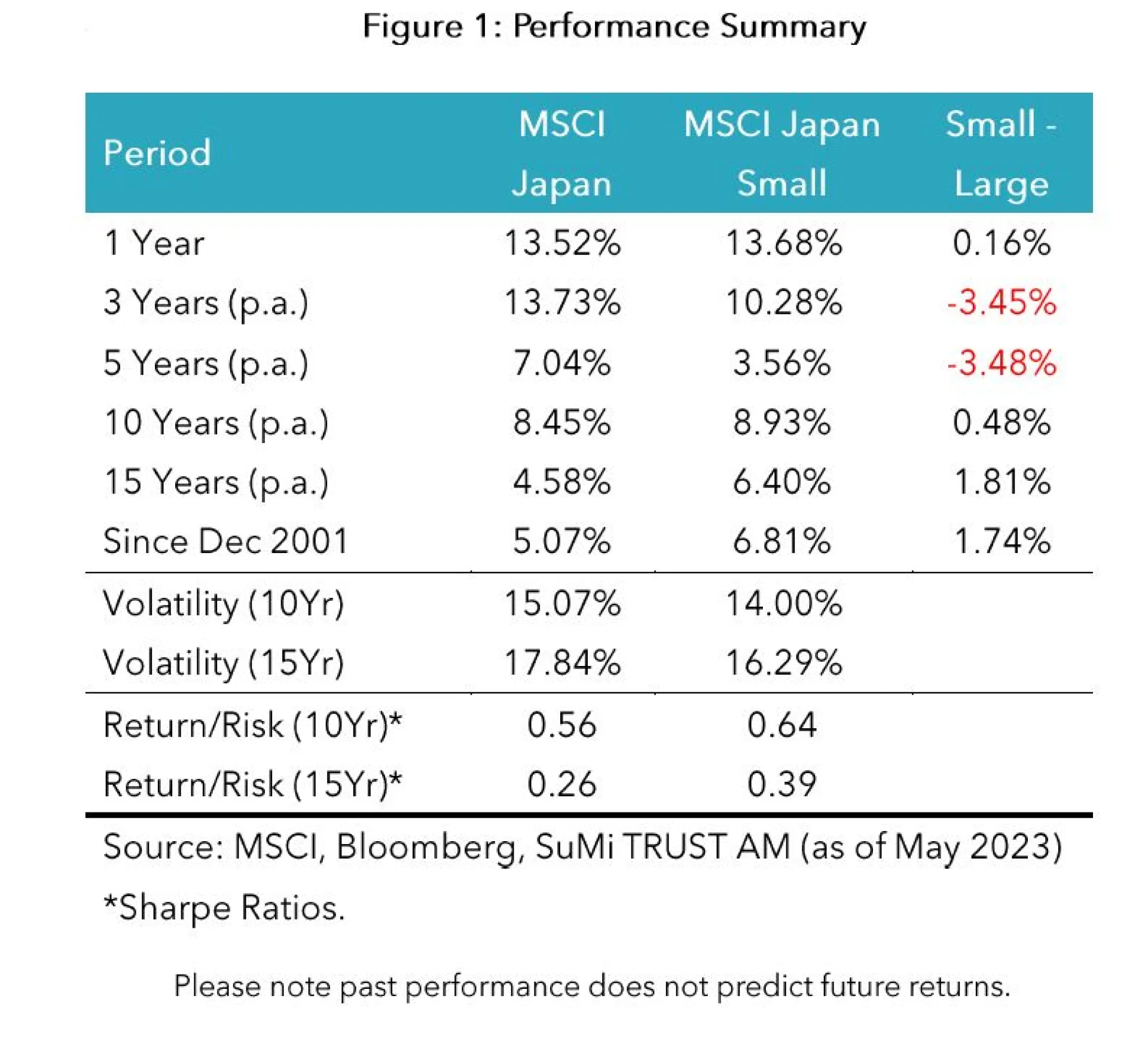

In the Japanese market, it has been the case when you look at longer term returns. Japanese small caps have outperformed their large cap peers by 1.74% annually since December 2001 and by 1.81% p.a. for the last 15 years. In addition, the historical volatility of Japanese small caps is lower than that of large caps, and as a result, smaller companies have delivered better risk adjusted returns than larger companies over the years. However, the outperformance became much smaller in the last 10 years and was negative in the last 5 years.

2. Small Cap Valuations: At the Bottom of the Range

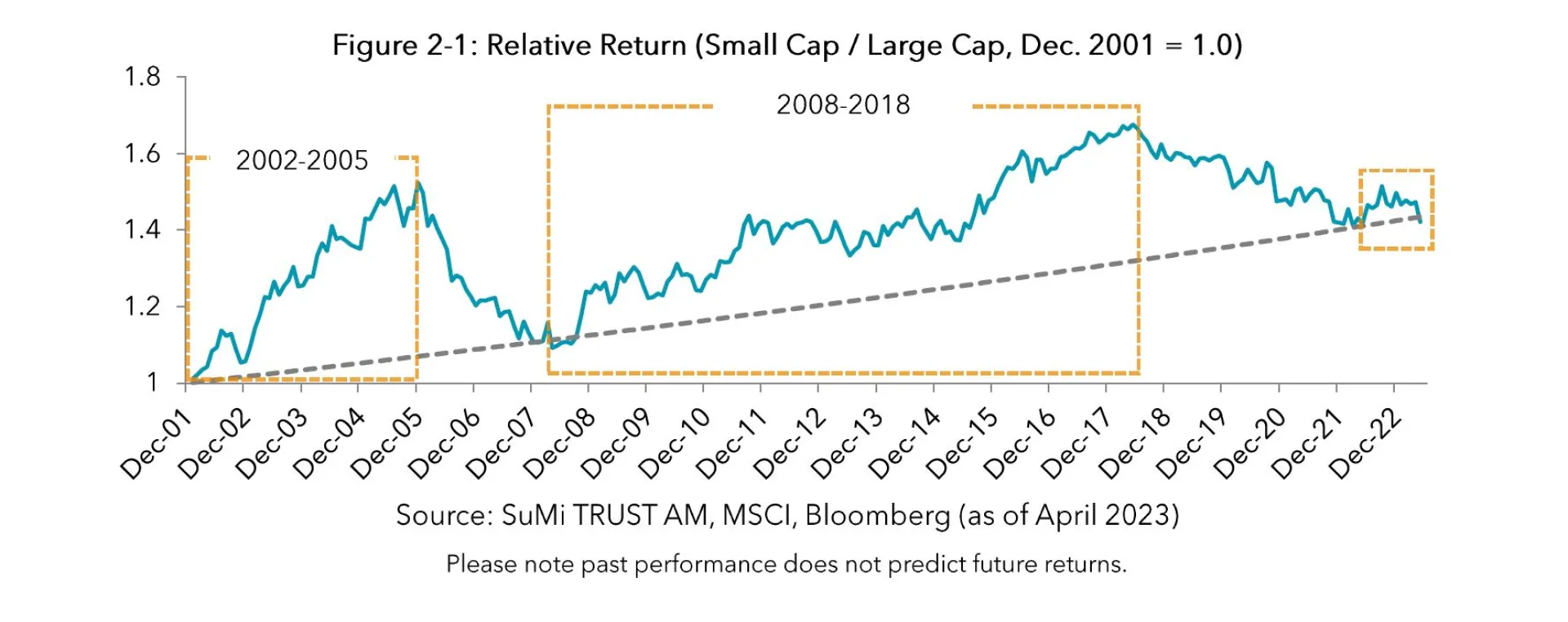

The fact that small caps posted higher returns over the long term does not mean small caps consistently outperform large caps. There have often been extended periods of small caps underperforming their large cap peers and times when the small cap market strongly outperformed the large cap market (See Figure 2-1). The blue lines show the relative performance of the Japanese small cap market against the large cap market and the dotted grey line indicates the annualised outperformance of 1.7%. The relative performance of small caps has stayed above the grey line. The small cap market outpaced the large cap market from 2002 to 2005 and lagged in the following 3 years. For the next 10 years from 2008 to 2018, the small cap market has consistently outperformed followed by a four-year period of underperformance. Although the relative return chart hovers around the 1.7% line, small caps have outperformed since Q2 2022, when the relative return chart hit the 1.7% line.

Trading between 16.4 times and 11.5 times P/E over the last ten years, Japanese small cap companies are now trading at 13 times their earnings. During the last decade, the Japanese small cap market has rarely been valued below 13 times P/E. It was only seen around market bottoms since Abenomics was introduced in 2013 (Figure 2-2).

3. Large Caps vs. Small Caps: Small Caps are Relatively Attractive

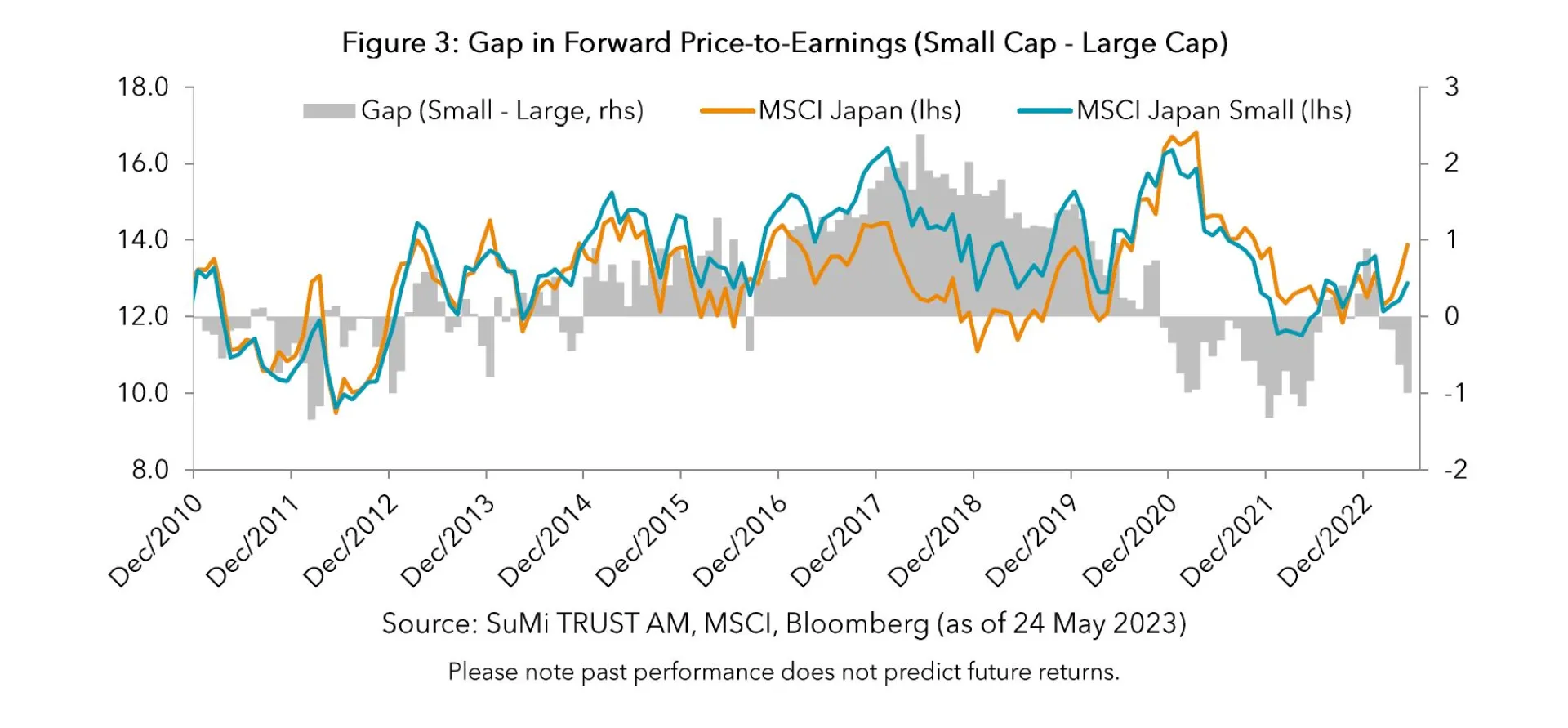

When it comes to forecasting relative performance of small caps against large caps, I believe that a valuation comparison provides useful guidance. Small caps are likely to outperform large caps in the proceeding years if the small cap multiple is lower than that of large caps, and vice versa. The valuation premium of small caps against large caps hints at future excess returns of the small cap market.

As shown in Figure 2-1, small caps underperformed their large cap peers from mid-2018 to Q1 2022. The fact that small cap stocks were valued at a premium to large cap stocks in 2018 (see Figure 3) indicated small cap underperformance in the following period. In 2022, the valuation premium became negative and small cap multiples were compressed. It was in Q2 2022 that the small caps hit the bottom. The small cap market is trading below the large cap market in terms of P/E and the gap is at the widest level in the last 10 years. It is not risky to say that the small cap market is attractively valued in a relative sense against its large cap peers.

4. Japanese Companies have Changed but Valuation has Remained Unchanged

Figure 2-2 shows that Japanese small cap valuation is almost at its lowest level in the last 10 years. The question we should ask is whether the Japanese equity market should be trading at the same level as 2012, prior to the introduction of Abenomics. Undoubtedly Abenomics changed the country. Japanese companies have improved their corporate governance, shareholder-friendliness, and profitability since then. It is fair to say that Japanese companies in 2023 are better managed than in 2012 from a shareholder perspective. Against this background, I do not believe it is reasonable for the much-improved small caps to trade at 2012 multiples.

Conclusion

Because the Japanese small cap market is trading at a discount to large cap stocks, the small cap market is likely to outperform their large cap peers in the coming years.

In addition to expected outperformance, I believe the current small cap valuation offers an attractive entry to investors. As entry valuation has a material impact on returns and because the Japanese small cap market is trading at the bottom of its range over the last decade, it is worthwhile to look into opportunities in this market.

Given uncertainties around the market including inflation, the economic outlook and rate hikes, it is difficult to predict the future direction of the market. In such a period, I believe, Japanese small caps, many of which operate in the domestic market and are less sensitive to the global economy, are a good place to allocate your investments. The Japanese small cap market offers alpha opportunities given limited research coverage by sell-side analysts on top of attractive valuations and the discount to large caps. I believe that the Japanese small cap market is a good place to deploy your money for years to come.