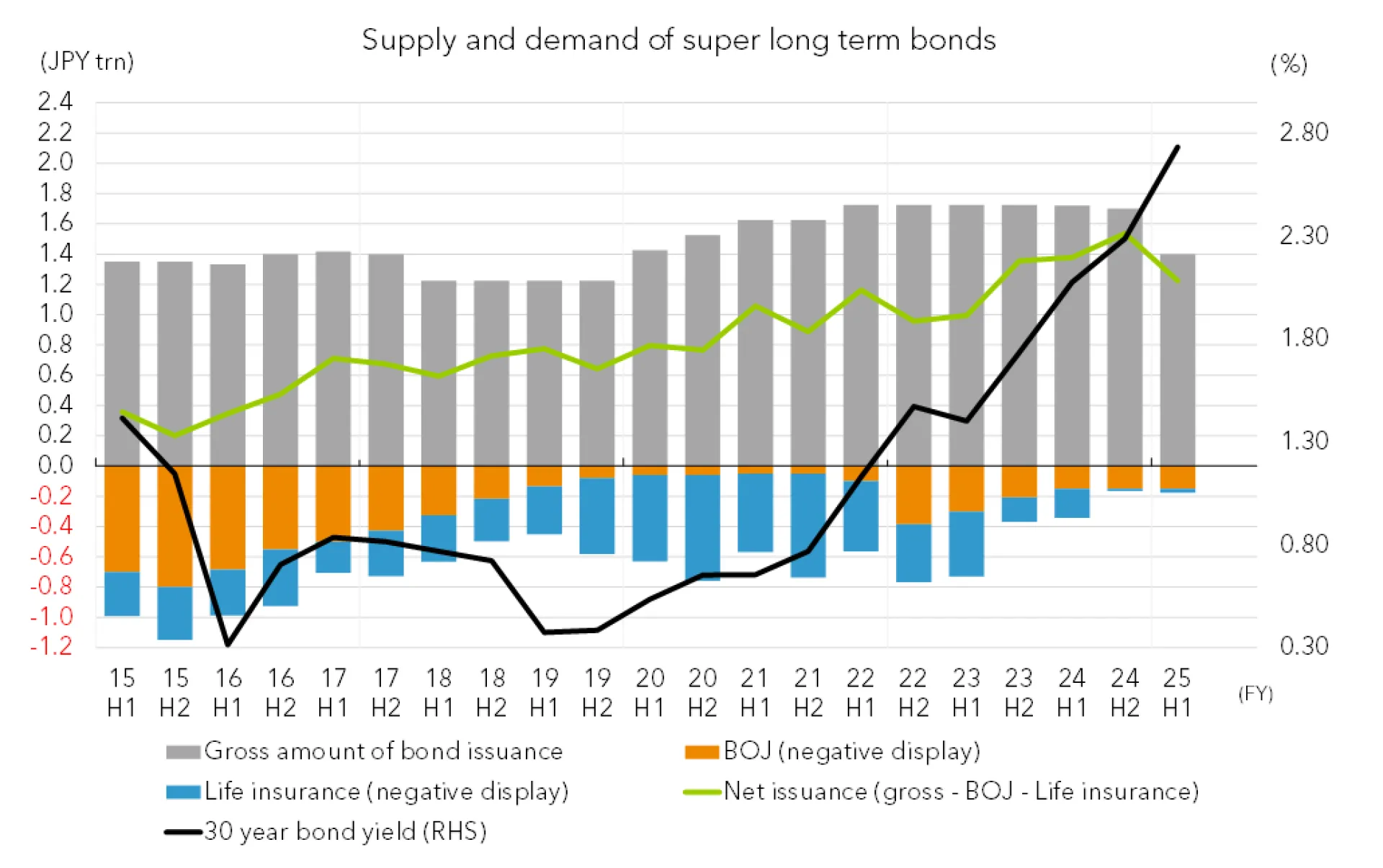

In response to the bond market disturbance, the government revised its FY 2025 bond issuance plan on June 23, further reducing ultra-long bond issuance. Even so, the structural imbalance between supply and demand remains unresolved, and given the inherent low liquidity, volatility is likely to remain high for the foreseeable future. This episode underscores the constraints that will significantly limit the government's funding flexibility going forward.

Changes in long-term yields; expansion of term premium

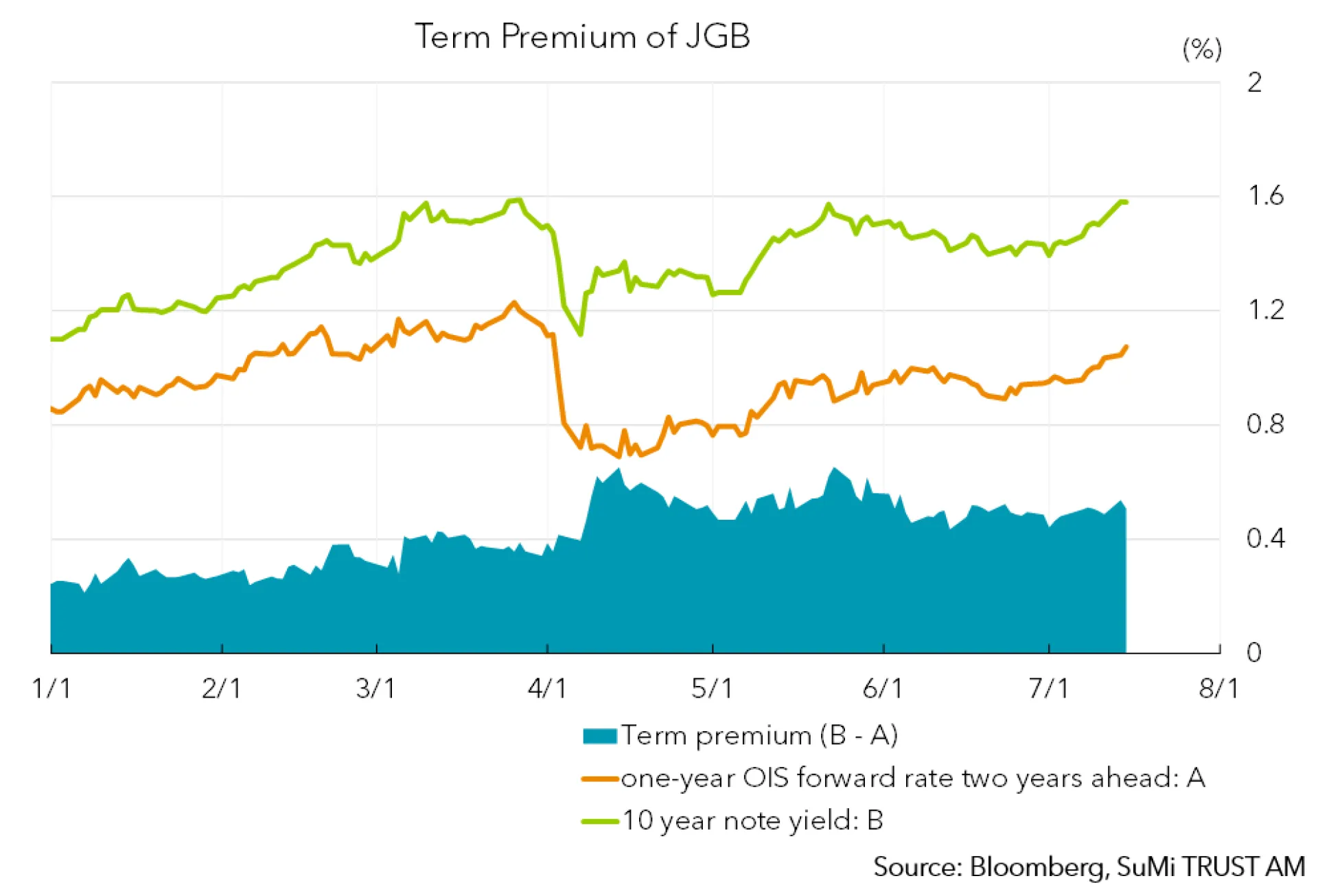

The 10-year JGB bond yield has maintained its pre-tariff levels. However, a closer analysis reveals a shift in factors driving yields higher. As the BoJ pursues monetary policy normalization, the 10-year JGB yield has gradually risen from around 0.5% to 1.5%. Previously, 10-year yields were primarily influenced by the policy rate outlook. Thus, as expectations for the BoJ’s rate hike endpoints increased, so did yields.

Since tariffs were announced, risks associated with holding bonds have driven yields higher. This is known as the term premium, calculated by subtracting the expected policy rate endpoint (one-year OIS forward rate two years ahead) from the 10-year yield. Our estimates indicate a rise in the term premium from around 0.3% at the beginning of the year to approximately 0.6% currently. The term premium incorporates predictions about future fiscal health, with the bond market seeking additional returns amid concerns over fiscal discipline. Both ruling and opposition parties proposed expansive fiscal policies ahead of the July upper house elections. As policymakers and the public remain reliant on a zero-interest rate environment and debate fiscal expansion, the bond market appears to be issuing a warning.

We forecast a gradual rise in 10-year JGB yields towards year-end, anticipating eventual rate hikes by the BoJ. Even then, with inflation (CPI) expected to be calm, we don’t foresee long-term rates exceeding 2%. However, continued fiscal expansion could heighten market sensitivity to bond-holding risks, potentially causing an unexpected rise in bond yields.

Conclusion

We believe Japan is entering an era of positive interest rates, and Japanese Government Bonds (JGBs) are becoming an increasingly attractive asset for both domestic and international investors.

However, fiscal discipline remains a risk factor that must be carefully considered. While we have observed the widening of the term premium, political debate as seen in last month’s Upper House election, continues to focus on tax cuts and subsidies. With the ruling coalition now a minority in both houses of the Diet, it will be necessary to incorporate opposition party views into the legislative process. If a consumption tax cut is implemented, it could lead to a downgrade of JGBs by credit rating agencies and trigger an unexpected rise in interest rates. To avoid such a scenario, it will be essential for the new coalition government, once formed, to engage in cabinet-level discussions on medium-term fiscal strategies, including how to manage rising defence and social security costs.

In the ultra-long-term bond market, where yields are particularly sensitive to fiscal conditions, demand remains weak due to structural factors on the investor side, and there is no clear prospect for significant supply cuts. Liquidity in this segment also remains low, suggesting that elevated volatility is likely to persist for some time. This stands in contrast to bonds with maturities of less than 10 years, which benefit from a more diverse investor base and greater market liquidity.

Even if the Bank of Japan proceeds with interest rate hikes, we do not expect the 10-year JGB yield to exceed 2% within this year. In such a case, the impact on the real economy such as personal consumption and capital investment, —is expected to be limited. As a result, we foresee no significant disruption to Japan’s path of stable economic growth.