Speculation about further normalisation of the BOJ’s monetary policy

On 22nd May, the yield on newly issued 10-year Japanese Government Bonds (JGBs) hit 1.0% in the Japanese bond market. It is the highest level in about 11 years since May 2013, just after the start of the quantitative and qualitative monetary easing policy. This indicates that monetary policy has moved away from being too influential and that the bond market is normalising.

The backdrop that pushed long-term interest rates higher was speculation that the Bank of Japan (BOJ) would further normalise monetary policy. In March, the BOJ decided to make major policy changes, including lifting negative interest rates. However, the BOJ is supposed to continue purchasing JGBs for roughly the same amount as before (about 6 trillion yen per month). This stance was perceived as the BOJ continuing to maintain monetary easing, which put pressure on the yen's depreciation in the foreign exchange market.

Under these circumstances, on 13th May, the BOJ reduced the amount of JGB purchases from 475 billion yen to 425 billion yen in its long-term JGB buying operations. This has led to the view that the BOJ will move quickly to raise interest rates or reduce JGB purchases further to reduce the upward pressure on prices due to the weak yen.

The strong influence of the BOJ’s monetary policy over the past 11 years

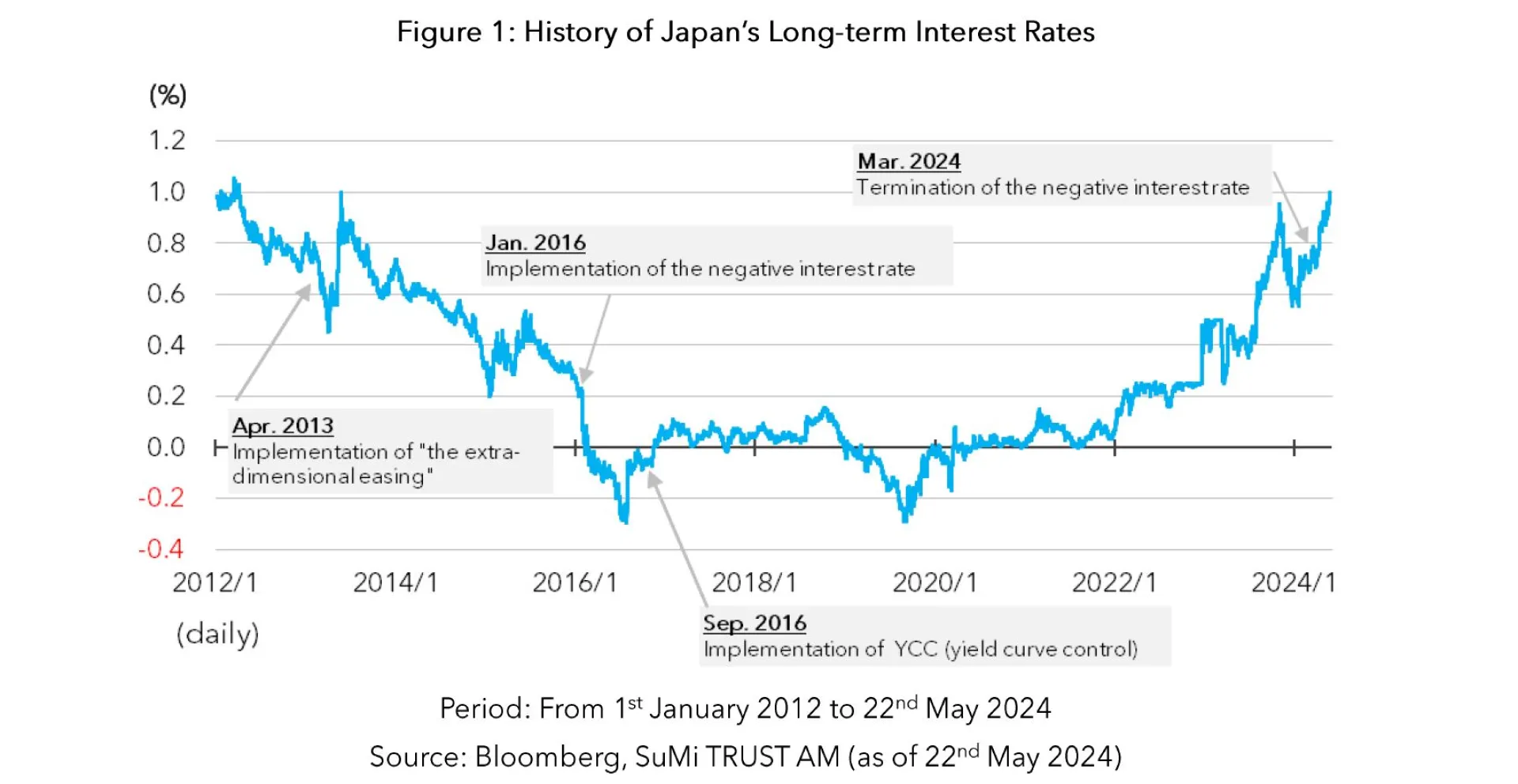

Let us review the movement of long-term interest rates over the past 11 years (Figure 1). Long-term interest rates had been entrenched below 1% since 2012 in a low-growth, low-inflation economy, which fell further below that level when the BOJ launched its extraordinary easing program in April 2013. In May 2013, when long-term interest rates rose globally after Ben Bernanke, the Chairman of the Federal Reserve Board (FRB) at that time, suddenly suggested a reduction in quantitative monetary easing, the rate temporarily soared to 1.0%, but has since gradually moved below 1%. After the decision to introduce a negative interest rate policy in January 2016, the 10-year rate entered negative territory for the first time in February and hit a record low of -0.3% in July of the same year.

With excessively low long-term interest rates, the BOJ began to recognise the side effects of increasing public anxiety about the future through the deteriorating investment environment for life insurance companies and pension funds. Therefore, an unusual yield curve control (YCC) was introduced in September 2016. Subsequently, due in part to rising global inflationary pressures, it has remained in positive territory since 2020.

In the fall of 2023, when the change in the BOJ's governor and other factors strengthened expectations of a normalisation of monetary policy, the rate was 0.97%, approaching 1.0% at one point. With the decision to lift the negative interest rate policy and YCC in March of this year, long-term interest rates rose again, reaching the 1.0% level for the first time in 11 years.

For the time being, long-term interest rates are likely to depend on whether and when additional interest rate hikes or further reductions in JGB purchases are made. It may also be affected by interest rate trends in the U.S. and other foreign countries, which will require attention.