Coffee Break Column

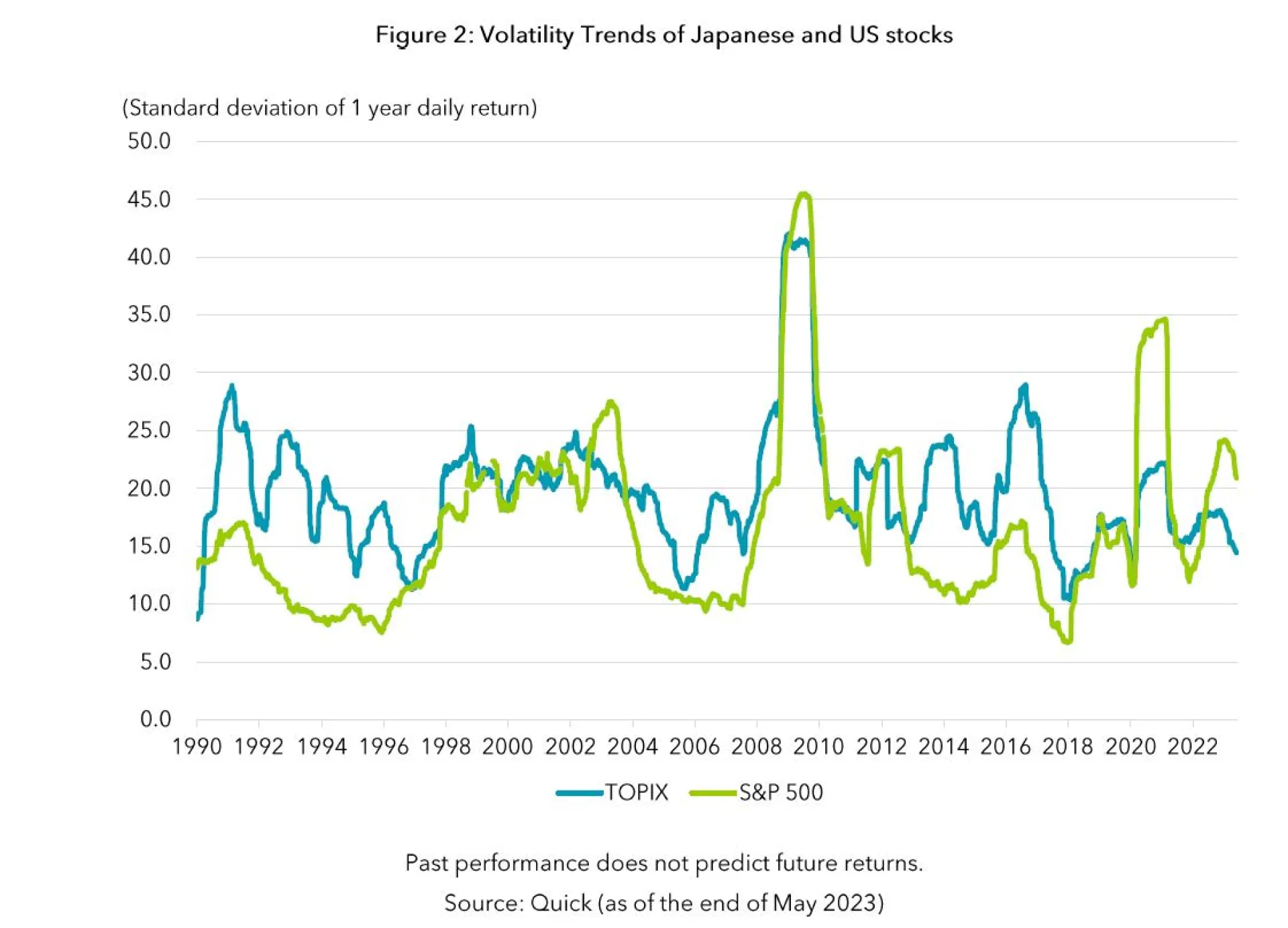

The recent strong performance of Japanese equities has attracted market interest, but did you know that the volatility of Japanese stocks has been improving recently compared with US stocks? In addition to similar performance, Japanese equities have a high risk-return efficiency, and while the volatility of US equities has increased after the COVID-19 pandemic, Japanese equities have remained stable. There was a time when market participants disliked Japanese stocks because of their high volatility, and they were considered "global cyclical stocks”. Indeed, during the global financial crisis of 2008, Japanese equities had a bumpier ride than US stocks, which were at the epicenter of the crisis. Japanese stocks, with a high proportion of manufacturing industries such as electronics and automobiles, are susceptible to the economy and structurally prone to large swings (Figure 2). However, a comparison of the Japanese and US stock markets shows a reversal of volatility (annualized standard deviation of daily returns) from 2020. In FY2022 this was 15.2% for TOPIX, a major stock market index for the Tokyo Stock Exchange (TSE) in Japan, and 23.2% for the S&P 500 and the returns were +3.05% for TOPIX and -9.60% for the S&P 500, resulting in a Sharpe ratio (return/volatility) of +0.20 for TOPIX and -0.414 for the S&P500.

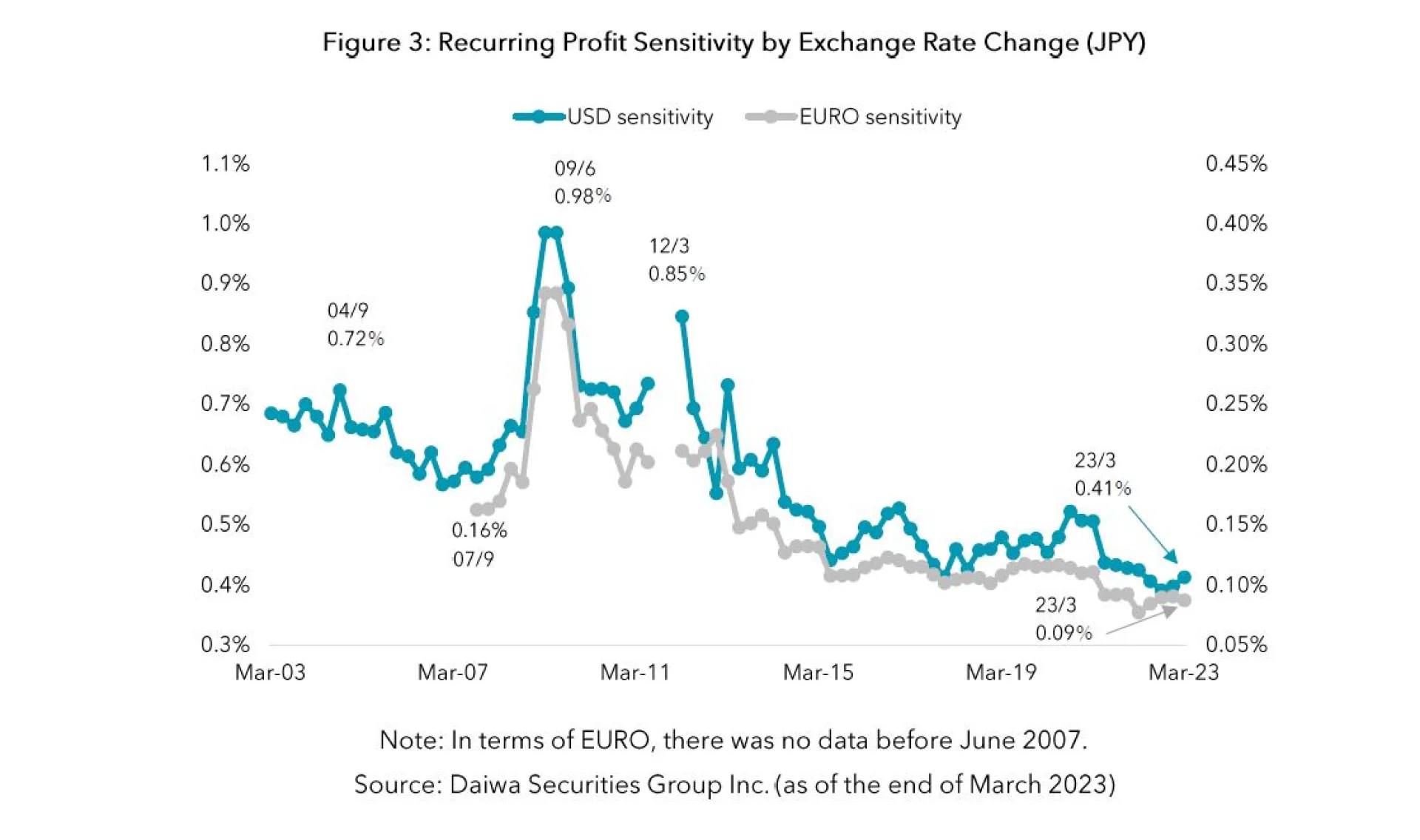

There are several reasons for this reversal. First is the difference in interest rate trends between Japan and the US. The Fed's rapid rate hikes in response to historically high inflation and the subsequent rise in long-term interest rates brought an increase in volatility to US equities. In Japan, interest rate trends are stable, partly because the Bank of Japan has announced that it will maintain its easy monetary policy under its new governor, Kazuo Ueda. While Japanese equities were also affected in the short term, volatility is now lower than before the COVID-19 pandemic. Additionally, the sensitivity of Japanese corporate earnings to exchange rates has declined, which has also contributed to the limited volatility (Figure 3). Japan's foreign-demand manufacturing industries had suffered under the strength of the yen before. In response they have increased overseas local production and procurement of foreign-currency-denominated parts and materials to reduce fluctuations in their business performance caused by exchange rates. As a result, their "durability" against exchange rate fluctuations has increased dramatically, although the benefits of the yen's recent depreciation have decreased. Another reason is that Japanese corporate earnings did not deteriorate as much as feared after the pandemic, and inflation remained relatively mild compared to other countries.

Looking ahead, as it becomes clear that the Bank of Japan will maintain its accommodative monetary policy even under a new governor, yen interest rates are expected to remain stable at low levels. The impact of foreign exchange rates on corporate earnings is expected to be limited. As such, volatility in Japanese equities is expected to remain subdued. In terms of room for upside, we believe Japanese equities have more upside potential compared to other markets. The reasons are as follows:

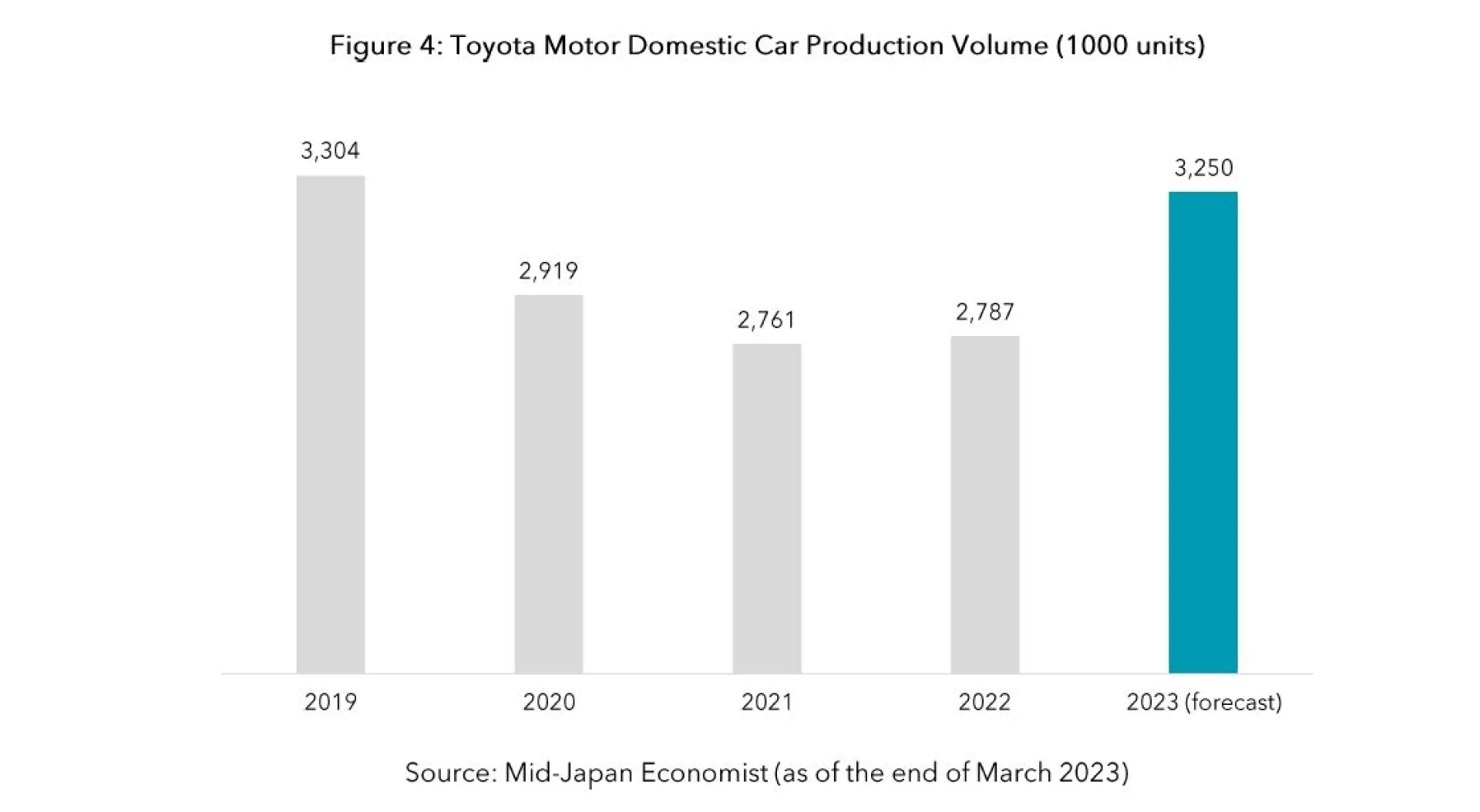

Although there are growing concerns about a recession in the US economy, Japan's economy is expected to remain resilient due to factors specific to Japan, such as inbound consumption and the normalization of economic activity following COVID-19, which was relatively recent compared to Europe and the US. We forecast this will act as a tailwind for corporate earnings, especially in the domestic non-manufacturing sector. In addition, the improving situation around semiconductor supply chains, which was a bottleneck in automobile production last year, will likely be a tailwind for markets. Toyota Motor expects an increase in production volume (Figure 4) and this kind of recovery across the sector is expected to be a considerable boost for the Japanese economy as it creates significant employment, which will have an enormous ripple effect.

In addition to growth potential and valuations, the magnitude of risk is also an important factor when investing in stocks. The current decline in volatility may further increase the attractiveness of Japanese equities and may be a factor in encouraging continued capital inflows from around the world.