Overview

This strategy aims to provide investors with long term capital appreciation through investment in equity securities listed on the Recognised Exchanges in Japan. We construct a portfolio through a bottom-up approach, identifying companies with the potential for EPS (earnings per share) growth over multiple years with above average ROE (return on equity).

Chief Portfolio Manager

Tatsuya has the ultimate decision-making authority and accountability for Japan Quality Growth Fund.

Tatsuya has the ultimate decision-making authority and accountability for Japan Quality Growth Fund.

He joined the firm in 1995 and became an analyst for Telecoms and IT services in 1999. Then he moved to become a portfolio manager of Japan Fundamental Growth (JFG) strategy * in 2005. He launched the Japan Quality Growth (JQG) strategy in 2015 as a spin-off of the JFG strategy as he was convinced that the change of Japanese companies’ attitudes to improve Return on Equity would provide investment opportunities.

He continues to work as a member of the JFG portfolio management team and discuss/share the investment ideas with the team. The investment philosophy of JQG is shared and well-understood by the members of the JFG portfolio management team**.

Tatsuya is a graduate of Waseda University with a BA in law. He is a Chartered Member of the Securities Analysts Association of Japan and was a member of a corporate disclosure study group within the Securities Analysts Association of Japan from 2006 to 2010.

Strategy Background

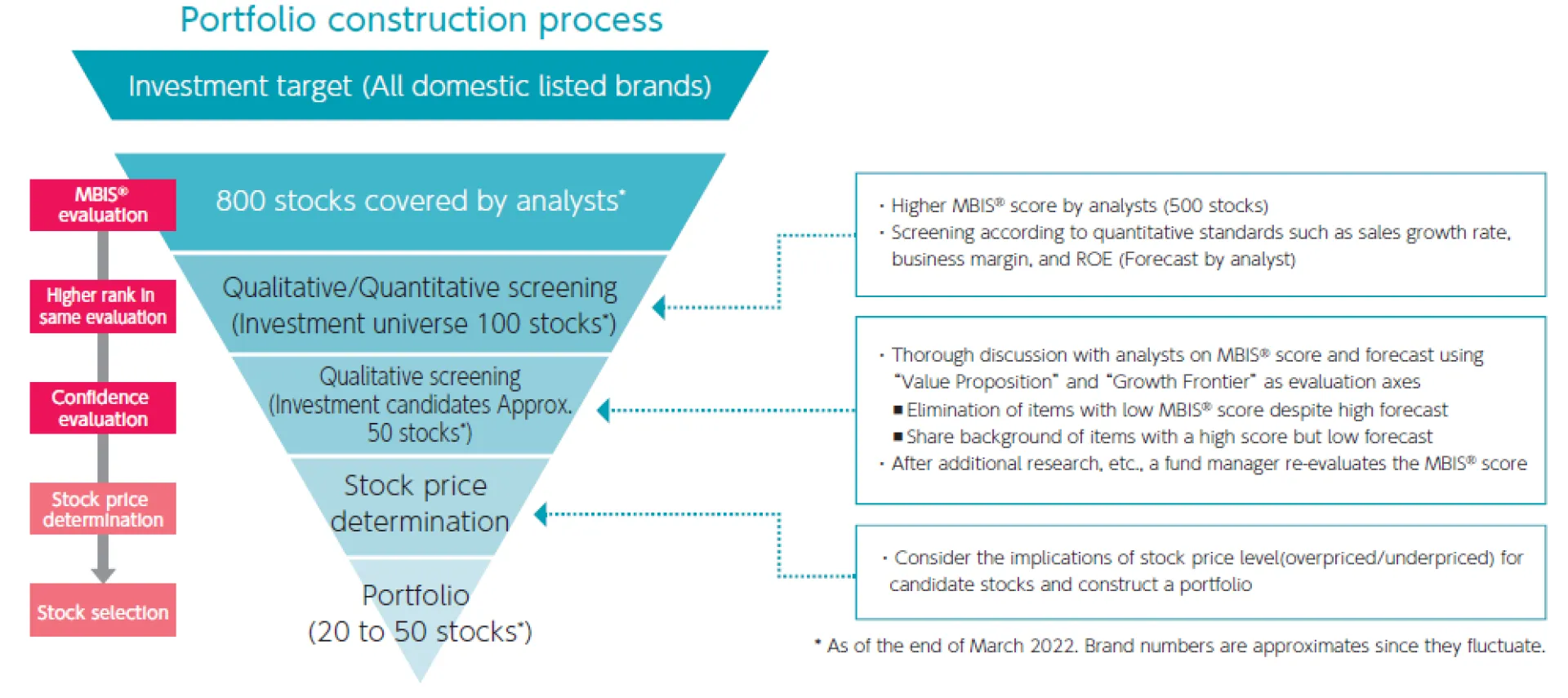

Rather than focusing on short-term performance, we invest in the medium- to long-term growth of companies and then return achievements back to the client. This is what led to the development of this strategy. In addition to financial information, analysis of non-financial information is important for determining sustainable growth, so we utilize MBIS®, which is our unique evaluation framework for assessing non-financial information, focusing investment on 20 to 50 stocks. With this product, the assumed investment period for individual companies is three to five years, so we encourage investee companies to improve their medium- to long-term corporate value and sustainable growth through engagement.